Financial Statements-Balance Sheet-Business Series

One of the basic financial statements required by the SEC and other regulatory agencies is the balance sheet shows the assets, liabilities and equities of a business at a given moment in time.

Assets which are either presented on the left side or the top portion, list down the resources of the company. The right hand side or the bottom portion shows the liabilities which represent claims against these assets by various creditos of the firm. The difference between these resources and claims is the networth of the owner or owners known as partners if it is partnership or shareholders/stockholders, if it is a corporation.

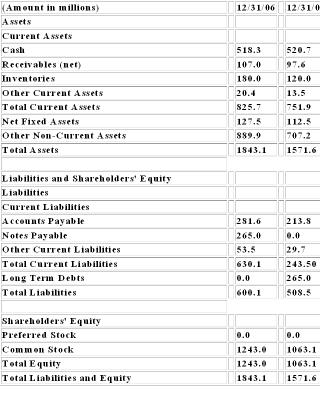

Since most of the balance sheets show comparative statistics, the top-to-bottom presentation is commonly used as shown below.

The pro-forma balance sheet above shows the assets, liabilities and shareholders' equity as of December 31, 2006 and December 31, 2005.

The purpose of comparative balance sheet is to show the changes that occurred between the two accounting periods.

Total assets amounted to $ 1,571.6 million in 2005. It increased to $ 1,843.1 in the year 2006.

Total assets equal total liabilities and equity so that the balance sheet shows the same amounts of the liabilities and equity for the two-year periods.

Next is the discussion of each item in the balance sheet.

Related articles:

1. The Financial Statements

Tags:

business,financial statements ,balance sheet ,statement,assets,shareholders+equity,liaiblities ,common stock

Comments on "Financial Statements-Balance Sheet-Business Series"

post a comment